Tax Relief Act 2024 Summary Form – Commissions do not affect our editors’ opinions or evaluations. Tax relief companies say they can work with the IRS and state tax agencies to reduce or eliminate your tax debt. But the Federal . The third chapter of the IT Act is basically about the charge of income tax, the scope of total income, dividend income, and income arising as a result of working abroad and so on. Chapter IV This .

Tax Relief Act 2024 Summary Form

Source : www.ncsha.org

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

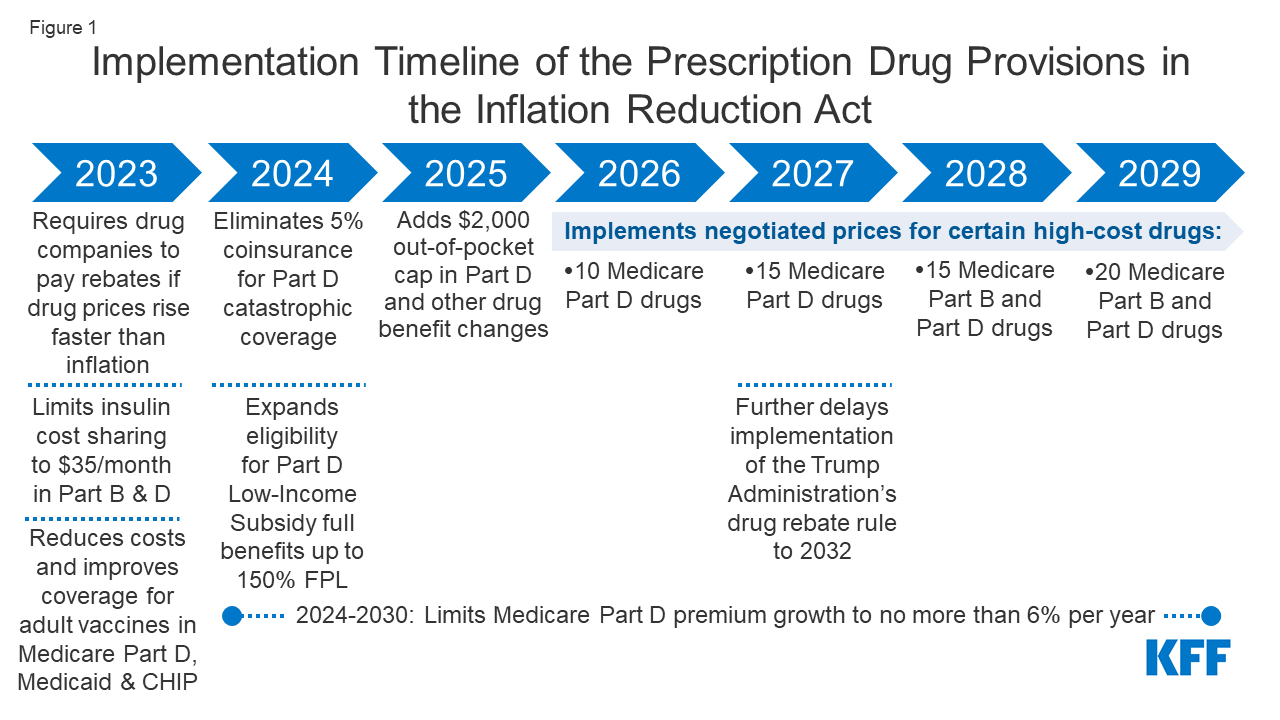

How Will the Prescription Drug Provisions in the Inflation

Source : www.kff.org

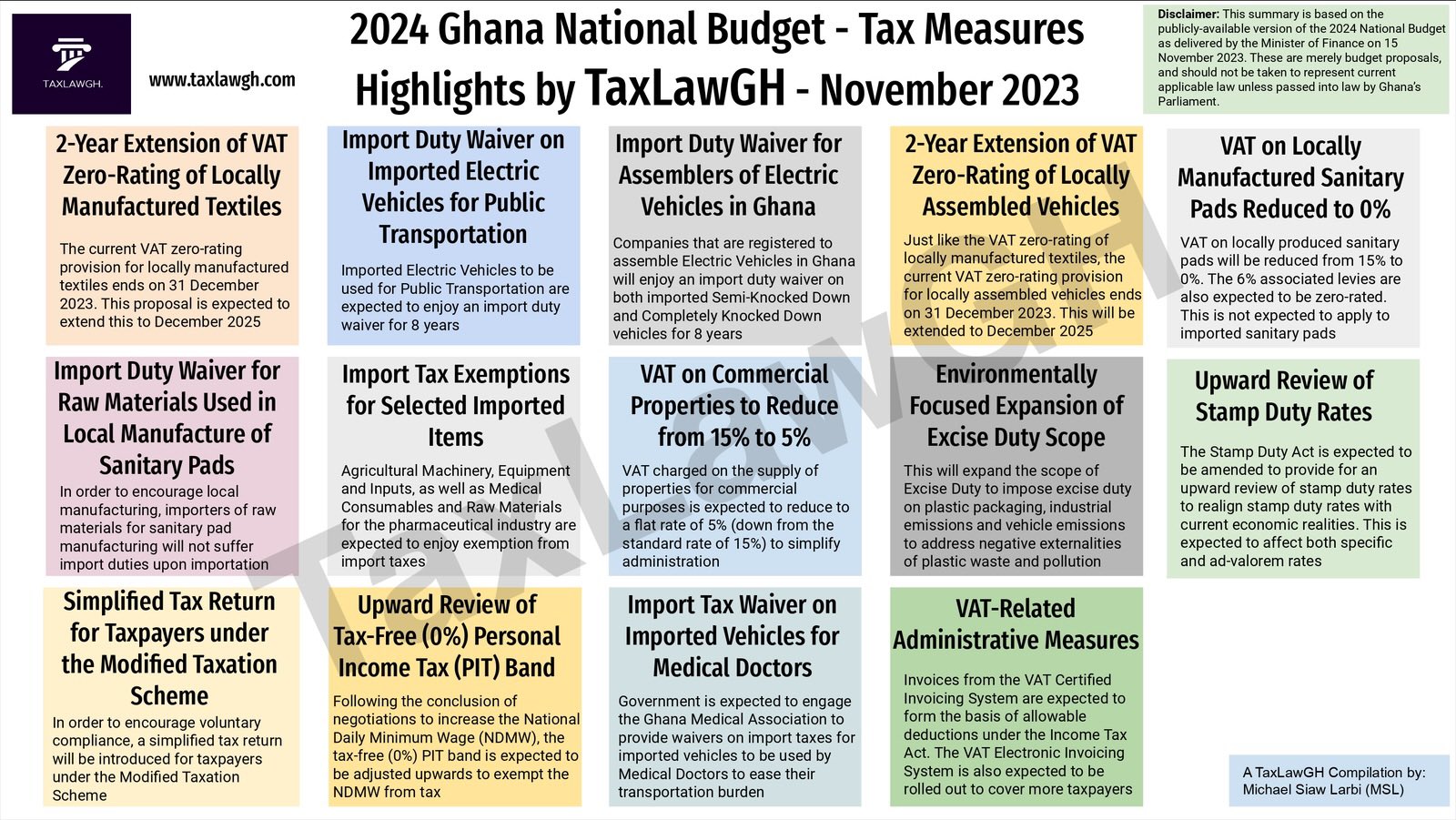

TaxLawGH on X: “In case you missed our 2024 Budget Highlights (on

Source : twitter.com

Enrollment Procedures for 23 24

Source : www.hillsboroughschools.org

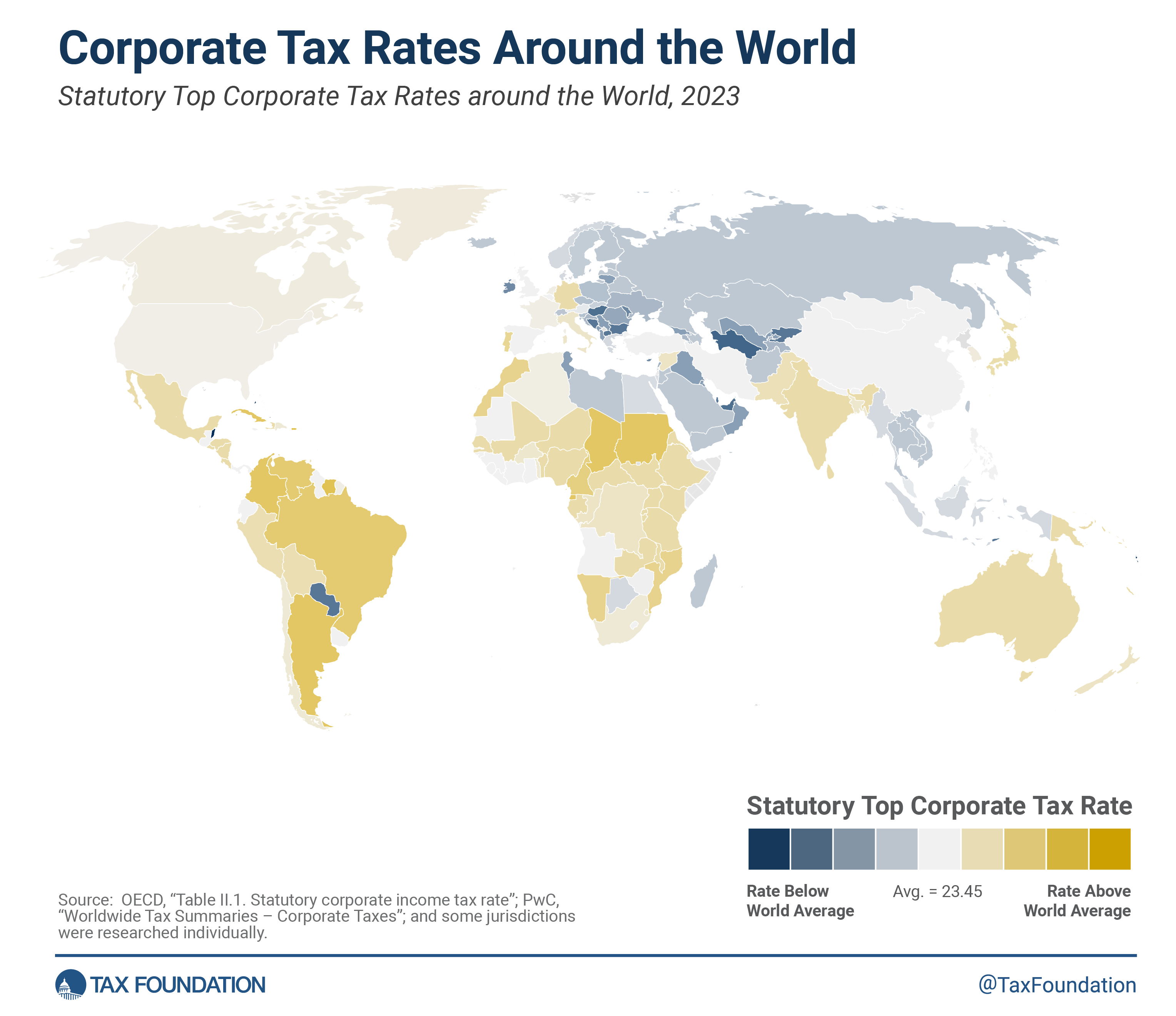

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

Countdown for Gift and Estate Tax Exemptions | Charles Schwab

Source : www.schwab.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

What’s in the Inflation Reduction Act (IRA) of 2022 | McKinsey

Source : www.mckinsey.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Tax Relief Act 2024 Summary Form Legislation & Legislation Proposals Archives — NCSHA: In October, Gov. Maura Healey signed a $1 billion tax relief package designed to benefit renters, caregivers, and seniors. The law went into effect when it was signed, but with residents poised to . Here’s what you need to know about when to file taxes in 2024. Ads by Money. We may be compensated if you click this ad.Ad The right Tax Relief firm need to file a Form 1040 (or Form 1040 .