New Child Tax Credit 2017 – Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how many children they have. . Congressional tax writers officially announced the details of a tax policy agreement. The deal includes expansions .

New Child Tax Credit 2017

Source : www.cbpp.org

T16 0249 Benefits of the Child Tax Credit, by Expanded Cash

Source : www.taxpolicycenter.org

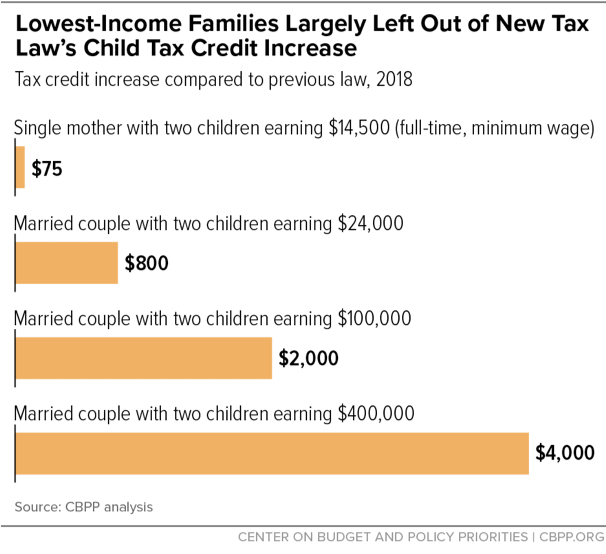

2017 Tax Law’s Child Credit: A Token or Less Than Full Increase

Source : www.cbpp.org

A new law in 2017 could slow tax refunds | cbs8.com

Source : www.cbs8.com

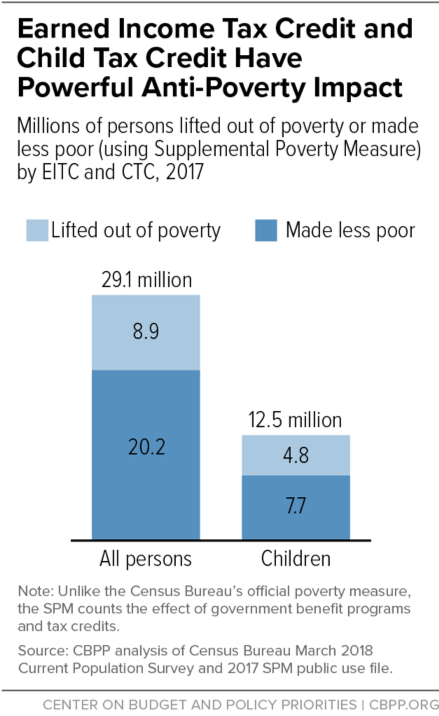

Working Family Tax Credits Lifted 8.9 Million People out of

Source : www.cbpp.org

What are tax credits and how do they differ from tax deductions

Source : www.taxpolicycenter.org

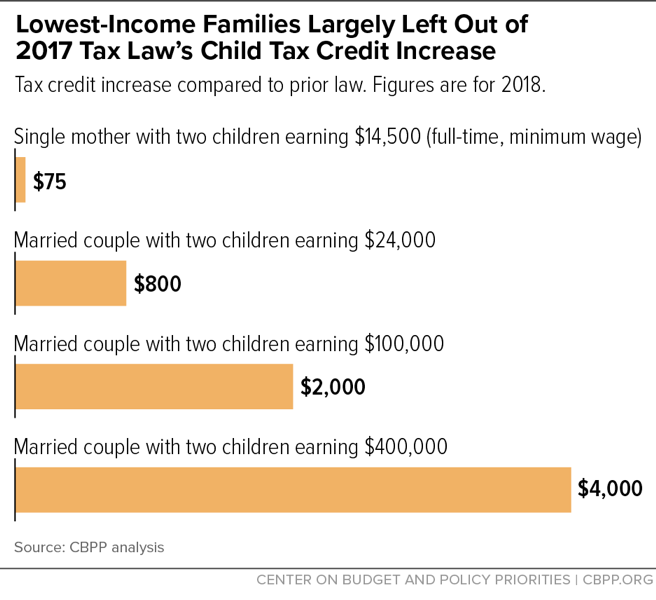

Lowest Income Families Largely Left Out of 2017 Tax Law’s Child

Source : www.cbpp.org

Inez E. Dickens Assembly District 70 |Assembly Member Directory

Source : nyassembly.gov

T22 0194 Repeal Child Tax Credit (CTC) Earned Income Threshold

Source : www.taxpolicycenter.org

Extending Temporary Provisions of the 2017 Trump Tax Law: National

Source : itep.org

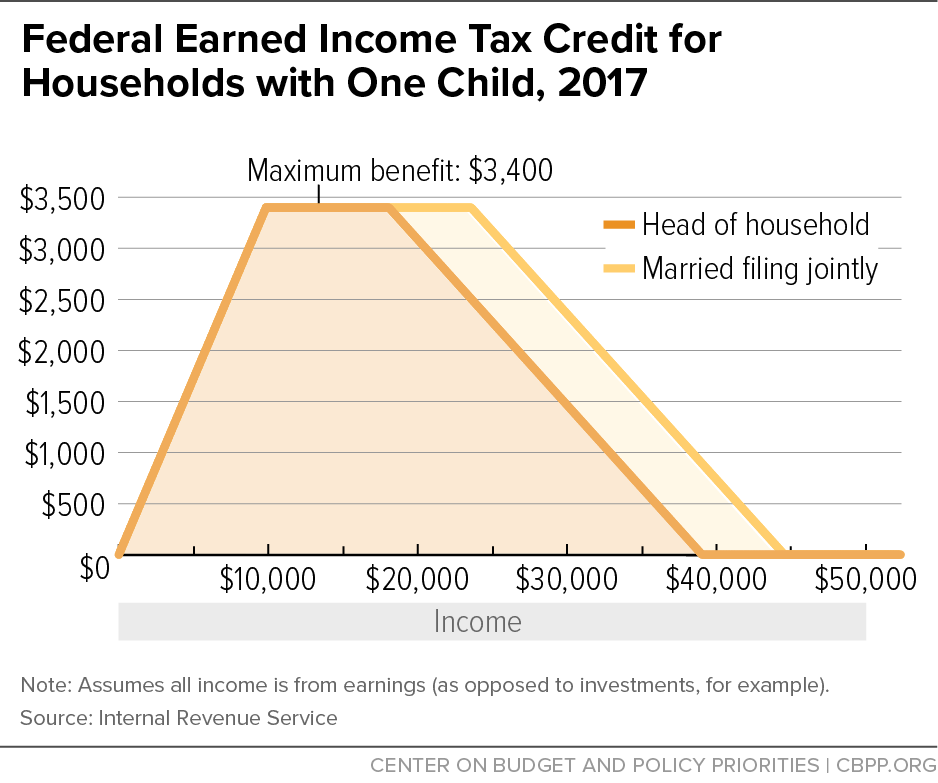

New Child Tax Credit 2017 Federal Earned Income Tax Credit for Households with One Child : WASHINGTON — Senior lawmakers in Congress announced a bipartisan deal Tuesday to expand the child tax credit and provide a series of tax breaks for businesses. . Our goal should be to end childhood poverty in this country,” said Senator Michael Bennet, a longtime proponent of expanding the child tax credit. Ohio Senator Sherrod Brown, another member of .